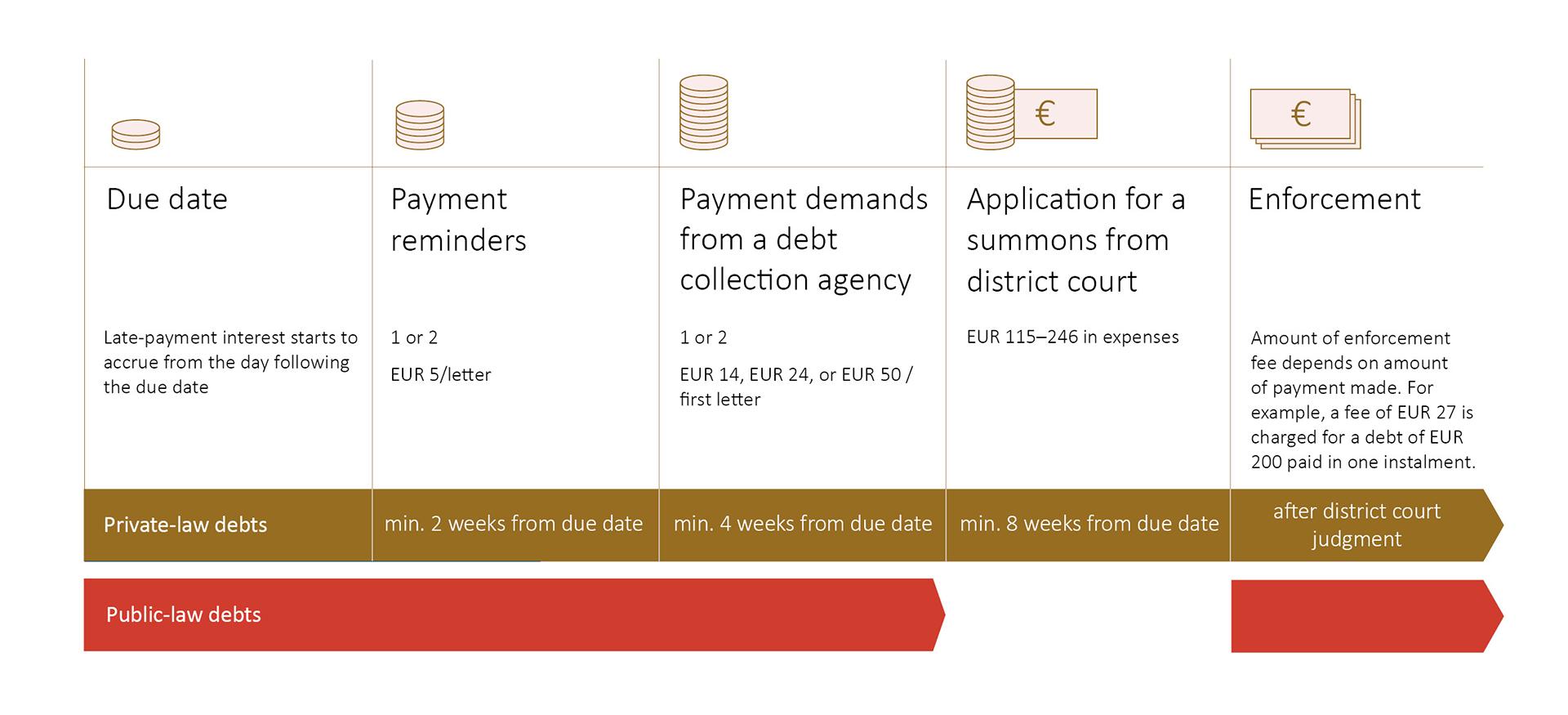

How debt collection proceeds

Collection of an unpaid bill usually proceeds in periods of two weeks. The more time has passed since the original due date, the higher the costs.

The creditor may send a payment reminder two weeks after the due date. Once two weeks have passed since the due date of the first payment reminder, the creditor may send another reminder.

If the debtor does not settle the bill after the second reminder, the creditor usually transfers it to a debt collection agency. The collection agency may send the first demand for payment four weeks after the original due date. The debt may be sent for enforcement action two months after the original due date at the earliest. Read more about transferring a debt to enforcement

.

You can download the graphic illustrating debt collection in accessible pdf format here. [pdf, 476.1 kB]

Each step in the collection process generates new costs that will be added to the original bill. After the due date, the creditor may charge the contract-based interest rate in late-payment interest for 180 days. If no other interest rate has been agreed on for the debt, the interest for late payment shall be 11,5 % (reference rate fixed under the Interest Act 4,5 % + additional interest 7 %, valid from 1 July 2024 through 31 December 2024).

How late-payment interests and debt collection costs are calculated

Example 1:

The original due date for a hospital bill of EUR 150 was 1 January 2020.

Late-payment interest started to accrue at the rate of 7% from the day following the due date.

By the time the bill was settled on 31 May 2020, the late-payment interest accrued over the period of 150 days totalled EUR 4.33. (interest rate x invoice sum x number of days of late-payment interest ÷ days of year, i.e. 0.07 x 150 x 150 ÷ 366 = EUR 4.33. Note: The divisor is 366 days because 2020 was a leap year). In addition, the debt collection costs arising from the unpaid invoice will be charged on the debtor.

Example 2:

A consumer credit (or a payday loan) of EUR 2,500 was due to be paid in full by 1 January 2019. Under the credit agreement, the annual percentage rate of charge is 216.20%*.

Since the debt was taken out after 1 February 2010, the interest rate under the credit agreement may be charged as late-payment interest for a maximum period of 180 days from the due date of the credit. Following this 180-day period, a statutory late-payment interest rate (7%) is charged.

The credit was paid on 31 December 2019. By that date, the loan had accrued late-payment interest at the annual interest rate of 216.20% under the credit agreement for 180 days, worth a total of EUR 2,665.48 (2.162 x 2,500 x 180 ÷ 365). Following this 180-day period, late-payment interest at the rate of 7% had accrued on the credit over the period from 1 July 2019 to 31 December 2019, worth a total of EUR 88.22 (0.07 x 2,500 x 184 ÷ 365).

When the credit was repaid, the balance payable totalled EUR 5,253.70 (principal EUR 2,500 + late-payment interests amounting to EUR 2,753.70). In addition, the debt collection costs arising from the unpaid invoice were charged on the debtor.

*) The credit was taken out before 31 August 2019. In all new contracts and agreements signed after 1 September 2019, the interest rate shall not exceed 20%.

Read more

More information on the debt collection process is available on the website of the Finnish Competition and Consumer Authority.

Frequently asked questions about debt collection can be found on the website of the Regional State Administrative Agencies.

Published 9.1.2023